New UK housebuilding, Modern British homes, United Kingdom building construction, House Price Index

New UK Housebuilding News

UK Residential Property Expansion + Housebuilding Issues: new home buyer searches data

post updated 4 January 2025

New UK Housing – current British housing updates

United Kingdom Housing Archive for Winter to Spring 2024:

16 April 2024

UK Housing Market Faces Further Uncertainty as Stamp Duty Reform Sparks Concern Amongst Property Experts.

Abolition of Multiple Dwellings Relief Could Prevent the Construction of 13,000 to 25,000 Homes, Jeopardising Up to 60,000 Associated Jobs.

The abolition of Multiple Dwellings Relief restored a historical injustice in Stamp Duty Land Tax (SDLT).

UK Housing Stamp Duty Reform

The UK’s housing market faces more turbulence as Jeremy Hunt announces his Stamp Duty reforms by eliminating multiple dwellings relief. Whilst the Treasury anticipates a revenue boost of £385 million annually by 2028-29, property experts argue that the move will stifle the construction of 13,000 to 25,000 homes, threatening 60,000 associated jobs and exacerbating the UK’s housing crisis.

Property buyers in the UK will now have to pay an increased amount of tax, with investors now having to purchase six or more units to reap the benefits of SDLT relief. David Hannah, Group Chairman of Cornerstone Tax, asserts that the UK government has generated another block to stop the property market from making a recovery.

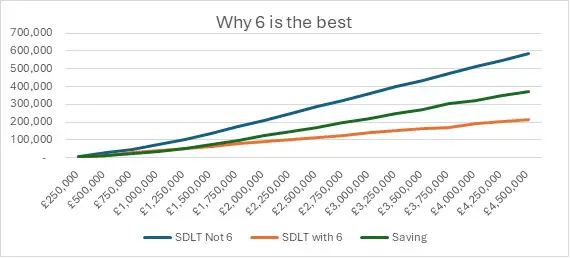

Currently, a property buyer purchasing three apartments from a developer at £350,000 each, would have to pay £46,500. However, once MDR is abolished in June, that same investor will have to pay £77,750. Property buyers in the UK who are eager to buy six units and pay the 5% rate of SDLT, will in effect have to pay £47,250 each which is less than the £77,750 they were being asked for, only slightly more than the £46,500 that they would have paid for under MDR. In reality, had the price been £400,000 each, the six units would have been cheaper than MDR.

The chart below shows the benefit that can be obtained by applying the rule of six on multiple purchases, as well as how the effect increases dramatically as the average price per dwelling increases.

UK housing Stamp Duty Land Tax (SDLT) 2024 chart:

As a result of this, purchasers of multiple units will either have to increase their minimum purchase quantity to six or, conceivably team up with other multiple purchasers into buying groups. This will enable them to buy six units collectively and to ensure that they receive the benefits of the non-residential rate and pay no surcharges whatsoever. The consequences of the abolishment of MDR, is that the Chancellor has, therefore, restored a historical injustice in Stamp Duty Land Tax. The UK’s Treasury and HMRC may well not see an increase in tax take but in fact a decrease, once these perfectly valid commercial arrangements become mainstream.

David Hannah comments:

“Multiple Dwellings Relief was first implemented as means to incentivise bulk purchases and provided developers with a suitable avenue for delivering low-cost homes. At a time when demand for affordable housing has skyrocketed, the government should look to create fresh incentives for developers, instead of abolishing old ones.

“The decision by the Chancellor to increase the tax that developers are forced to pay from 1-2% to 5% will have a seismic shift across Britain’s construction sector, leading to project abandonment and further increases to asking prices as supply continues to lag behind an overwhelming demand for affordable housing. Don’t be fooled, this is a stealth tax increase with a paper-thin justification laced over the top of it.

“The Chancellor could have used this opportunity to reform the private rental sector, measures including the abolition of the second home surcharge from rental sector investors and reinstating full relief on mortgage interest payments would have both reduced the costs of purchase, whilst also allowing landlords to freeze, or potentially cut, rents.”

Previously on e-architect:

26 March 2024

Critical insights into UK’s housing delivery highlighted in new report

UK Housing Delivery Report

Key insights into the current state of the housing landscape are covered in the third edition of national planning and development consultancy Lichfields’ industry-leading housing delivery analytics report, Start to Finish.

The latest edition of Start to Finish highlights key trends in the changing dynamics of housing delivery across England and Wales and shows how this has been impacted by the end of Help to Buy loans and an uptick in mortgage rates.

With the chronic housing crisis and the forthcoming general election, the discussion around accelerating housing delivery is more pertinent than ever – especially if the Government’s target of 300,000 new homes per year is to be achieved.

The new study assesses what has happened on the ground in respect of 297 sites delivering a combined 387,000 dwellings. It provides a detailed look into the delivery of large-scale housing sites, including 179 sites each yielding 500 dwellings or more.

Key findings from the report demonstrate the nuanced landscape of strategic housing development:

• Smaller sites of fewer than 100 units typically start to deliver new homes within a five-year timeline from the submission of the first planning application, while larger sites demonstrate extended planning and pre-commencement phases beyond five years.

• Compared to the previous versions of Start to Finish, the new research points towards a slight decrease in annual build-out rates across sites of all sizes, a forecast echoed by the Office for Budget Responsibility’s (OBR) predictions for 2024 with the phasing out of Help to Buy and climbing mortgage rates.

• Local demand for housing is a key driver for build-out rates, with areas of higher affordability ratios witnessing greater build-out rates.

• The variety of housing, including a higher percentage of affordable housing and the presence of multiple outlets, also contributes towards enhanced build-out rates.

• Large-scale apartment schemes on brownfield land show potential for high annual build-out rates; however, their delivery is subject to market fluctuations and often encounter extended planning-to-delivery periods. Their delivery can also be more ‘lumpy’ than conventional housing schemes because entire blocks of flats are typically recorded as having been completed on the same day.

Rachel Clements, Associate Director at Lichfields said: “In the current climate, the housing market faces fresh challenges and the urgency for housing delivery is undisputed. The findings in this third edition capture the nuanced realities of strategic housing delivery, presenting significant, on the ground evidence, crucial to inform realistic plan making and decision-taking outcomes.”

The first two editions of Lichfields Start to Finish report are the primary reference points for industry professionals and continue to inform numerous Examination in Public (EiPs), inquiries, and the formulation of local authority Five-Year Supply (5YS) assessments. Lichfields is committed to leading the conversation on housing delivery with the third edition of Start to Finish.

The full report can be viewed here https://lichfields.uk/content/insights/start-to-finish-3

Previously on e-architect:

19 February 2024

Housebuilders call for Jeremy Hunt to cut stamp duty ahead of Spring Budget

Prospective buyers continue to find themselves priced out of the market amidst an ongoing affordability crisis

David Hannah, Group Chairman of Cornerstone Tax, joins the call for stamp duty reform – emphasising a need to overhaul the current ‘outdated’ thresholds in a bid to boost transactions:

Three of Britain’s biggest housebuilders, including Taylor Wimpey, Barratt Developments and The Berkley Group, have each called upon Jeremy Hunt to reform stamp duty ahead of the Spring Budget on March 6th. Pressures ranging from the ongoing cost-of-living crisis, record interest rates and crippling deposit requirements have continued to weaken the UK’s housing market, dissuading would-be first-time buyers from making that big purchase amidst what many are calling a crisis of affordability. A cut to the rate of stamp duty for lower-priced properties and a reduced levy for sellers over the age of 60 looking to downsize would purportedly encourage market activity and rejuvenate a market that’s long been at a standstill. According to David Hannah, Group Chairman of Cornerstone Tax, the UK’s leading property tax consultancy, the chancellor should use the Spring Budget as an opportunity to overhaul the current SDLT regime and reform the current ‘outdated’ thresholds in a bid to reinvigorate the market from the bottom-up.

Ahead of the Spring Budget, MPs have urged the chancellor to prioritise SDLT reform as a means to generate new incentives within the market. One such proposal includes a prospective stamp duty cut for energy efficient homes, whilst others echo a report sponsored by Lords Mandelson and Heseltine which asserts that elderly homeowners should be exempt from stamp duty outright in a bid to encourage top-down movement via downsizing. All the whole, SDLT revenue has taken a significant hit in recent months as transaction numbers continue to fall year-on-year.

According to David Hannah, one easy fix for policymakers would be to reassess the current thresholds for stamp duty payment, homes that are valued at £250,000 or less are currently exempt, with a 5% levy charged on any valuation between £250,000 and £675,000. However, with the current price of a UK home standing at almost £290,000, it’s clear that SDLT payment bands are long overdue an overhaul. This problem is exacerbated in the capital, particularly amongst first-time buyers as the increased £450,000 threshold continues to decouple from the rising cost of starter homes, with prices leaping by over a fifth in just five years across certain boroughs, according to the Land Registry’s data. Index-linking payment thresholds to house-price inflation would, according to David Hannah, have the knock-on effect of encouraging those looking to move-up the housing ladder to sell their lower-end properties, stimulating demand amongst an overcrowded demographic and generating momentum within Britain’s frozen housing market.

David Hannah, Group Chairman of Cornerstone Tax, comments:

“SDLT payment bands have long been due for an overhaul as they have never been index-linked to house price inflation. An increase to these thresholds would stimulate market activity as the lower end of the property market and allow first-time buyers to reduce the amount they need to borrow, thus improving their affordability calculations.

“As we all know, a rising tide lifts all boats, those looking to purchase properties on the mid-to-high end of the market will now have a chance to sell their low end properties as a result of the increased demand from perspective buyers, contributing to further momentum within the housing market.”

13 February 2024

As Michael Gove looks to relax property planning laws, focus shouldn’t just be on new builds

UK Property Planning Laws Relaxation

By Daniel Austin, CEO and co-founder at ASK Partners

13th February 2024 – The UK has a widely reported and growing housing shortfall as a result of under building since the 1950s. A broken planning system and local objections have been blamed and aside from the human cost, this has become a major economic problem. It is very hard to increase growth without being able to provide homes, and the associated infrastructure, for workers in high growth sectors such as life sciences, pharma and tech.

We have recently seen a number of planning decisions referred to the Secretary of State which can delay the delivery of schemes by years and create such uncertainty that developers are reluctant to take the risk. With an election on the immediate horizon both political parties are making promises to fix the planning system, but with political agendas becoming ever more populist, the question is whether either party can come up with plans that will genuinely accelerate growth without losing them votes; which is the exact reason why central and local government should not be involved in the planning process at all as they cannot be impartial in controversial decisions which have a major impact on their electorate.

An often overlooked and relatively new aspect of the potential for housebuilding growth in the UK is adaptive reuse. This process, which involves repurposing existing structures for new functions has become a popular development strategy since the Covid pandemic, with developers actively seeking out those assets which will benefit from being re-positioned to take advantage of the shift in occupier demand, such as office to residential conversions. These projects are easier to obtain financing for as loans can be secured against a fixed asset rather than a piece of land. Construction risks are reduced and critically in an inflationary environment, costs are also lower.

It is also a more sustainable approach, emitting less carbon than demolition or ground up development. Crucially, it can skirt planning hurdles altogether. In some cases, conversions can be carried out under permitted development rules. One such example is an office building in Solihull which was converted into 181 apartments under permitted development and with minimal changes to the core structure of the main buildings. The project was completed on time and on budget given the lower construction risks.

Permitted development projects are not always possible but where full planning permission is required, conversions of existing buildings are far less likely to receive local objections. Locals tend to be in favour of breathing new life into unattractive disused buildings and boarded up shops to bring back a vibrancy to the local area and economy. An example in this case is the Z Hotels group, which has acquired a number of central London sites for conversion into its now well-known compact luxury hotels. ASK recently financed the acquisition of a vacant office block in Leicester Square which the group now has planning to convert into a further hotel in its portfolio.

Furthermore, research carried out by the homeless charity, Crisis, found that there are currently 250,000 homes sitting empty and in disrepair in the UK. Not repurposing them is clearly a missed opportunity to provide genuinely affordable housing for those in need and proof that it’s not all about new builds; it just requires a change of mindset. The repurposing approach also unlocks development opportunities for small and medium sized (SME) developers.

As a specialist real estate debt provider, these are the kind of creative property developers we want to support and who can contribute to creating a resilient, sustainable, and vibrant real estate sector that aligns with the diverse needs of communities and the ever-evolving landscape of the UK. As such, we offer bespoke lending solutions, in many cases at the pre-planning stage, based on our flexible underwriting process which enables us to evaluate projects factoring in location, underlying land value and potential. So, whilst the planning system remains a huge hurdle in the UK, there are huge numbers of existing buildings ripe for refurbishment and conversion which just require creative strategies that align with the changing demand for the built environment to help them become the much-needed homes we require, and in a less controversial and more sustainable way.

Previously on e-architect:

27 January 2024

Make UK Modular response to Built Environment Committee letter to Secretary of State

Daniel Paterson, Director of Government Affairs, Make UK Modular said:

This report is heartening and recognises the important role that Category 1 modular is already playing in solving Britain’s homes crisis, with global leading projects currently delivering thousands of homes.

The Committee is right to point to a need for greater clarity around policy which, if it is got right, will ensure a stimulated market at a critical time for homeowners and renters alike. Unblocking the delivery of the 300,000 homes our country needs every year is key, and Category 1 modular can help deliver affordable homes which are economic to run in an ever-tightening labour market.

The current Future Homes Standard consultation aims to make sure all new homes are built to a higher standard from 2025. Make UK Modular encourages the government to use this as an opportunity to listen to innovators in the construction sector on the importance of high fabric standards as a critically important method of increasing sustainability in our future homes.

By doing so, the Government can develop a solid long-term strategy prioritising the most innovative forms of building that are already delivering tangible value for the UK while ensuring that innovators within industry do not face penalties for challenging outdated methods of working.

25 January 2024

New JELD-WEN whitepaper highlights social housing security concerns

New UK Housing Security

• In partnership with Secured by Design (SBD), the whitepaper calls for dual certification of entrance doorsets as standard within all multi-occupancy properties

• It follows research that found social housing tenants are concerned that their home does not offer adequate security against break ins, despite also feeling that crime is on the rise

25th of January 2024 – The UK’s leading door manufacturer, JELD-WEN, has published a new whitepaper that calls for dual certification of doorsets to become a legal requirement within all multi-occupancy developments.

The whitepaper, titled “Turning the Key Towards Better Security” has been published in partnership with Secured by Design (SBD), the official UK police initiative that helps to deter and reduce crime, to explore the critical role that secure front entrance doorset design can play in helping to keep multi-occupancy properties secure and prevent burglars from breaking in.

It sets out the purpose and effectiveness of secure doorset design, assesses current regulations and accreditation within the industry, and considers the wider factors impacting levels of crime, such as cost-of-living, neighbourhood deprivation and technology.

Contents of the whitepaper also address research1 conducted by JELD-WEN, which explored how secure those living within social housing felt within their homes.

It found that tenants believe the level of security offered by their landlord falls short, with a quarter (23%) of those living in multi-occupancy properties having experienced a security breach over the last 12 months (rising to 35% in London).

Almost half of all respondents believed that crime was increasing in their area, and a quarter (24%) felt that their front door wasn’t secure. This has led to many residents taking matters into their own hands, as 47% have purchased additional home security devices, such as CCTV, recording doorbells and security lights.

Despite the government’s commitment to ensuring landlords engage with their tenants and help to make sure they feel safe and secure in their home, two thirds (66%) of social housing tenants reported that they had never received communications from their landlord about ways they can achieve better security in their building.

Unsurprisingly then, almost a third (32%) of respondents admitted to leaving their front door unlocked overnight, and 57% said they would leave it unlocked during the day – even though this is the most common timeframe of opportunity for thieves.

Commenting on the whitepaper, Glyn Hauser, R&D Senior Group Manager at JELD-WEN, said: “It is worrying that a third of social housing tenants (33%) do not feel adequately protected from the risk of a break-in, particularly as the ongoing cost of living crisis presents a potential surge in crime over winter.

“We’re also concerned that many break-ins can be attributed to entrance doors that have been left open, which is a clear indication that there is a huge awareness task in terms of educating residents about how they can improve the security of their home.”

The research found that an overwhelming majority of residents asserted that security from break-ins (80%) and fire protection (48%) are the most important functions of a front door, which JELD-WEN believes supports the growing case for dual-certification as standard practice.

Glyn continues: “Ultimately, a secure entrance doorset is one of the most effective ways of deterring and preventing a burglar breaking in, but only when it is installed and maintained correctly. However, there is still no legal requirement for this critical security product to be installed by a person with any professional qualification, or reviewed and maintained in the same way that Fire Safety (England) Regulations require.

“As such, and in response to our research findings, we believe the opportunity to apply dual-certification, which is already a SBD stipulation, could help build better traceability, accountability and trust throughout a door’s lifecycle.

“It is our hope that this whitepaper, along with its recommendations, proves a valuable resource and helps to inspire some of the progressive action needed to raise security standards.”

Jon Cole, Chief Operating Officer at Police CPI, who own and administer the Secured by Design (SBD) initiative, commented: “Turning the Key Towards Better Security is an important whitepaper, which investigates how to elevate standards for door security across the board.

“Naturally, this aligns with the work that SBD has done and continues to deliver to improve the security of buildings and their immediate surroundings to provide safe places to live, work, shop and visit.

“The consistently high reductions in burglary rates and anti-social behaviour which SBD developments and properties have seen over the years is based on the use of certificated products, rather than those that are just tested to the relevant standard. This highlights the importance of doorset manufacturers like JELD-WEN, who are investing in the future to ensure safe and secure buildings that promote cohesive and sustainable communities for generations to come.”

‘Turning the Key Towards Better Security’ is now available for free to download at https://www.jeld-wen.co.uk/contact/security-white-paper. Visit www.jeld-wen.co.uk for more information.

1 One Poll survey of 1,000 social housing tenants, conducted September 2023

+++

New UK Housing – current British housebuilding news

UK housebuilding news – Housing News in 2023

Previously on e-architect:

United Kingdom Residential Property

Recent UK housing news on e-architect:

UK brownfield land for affordable MMC housing

Make Modular: UK Housing Delivery

New UK homes for the North and Midlands

Too little, Too late? Housing for an ageing population

++

Location: UK

Contemporary British Homes

Recent British Home Designs

UK Housing Links:

English Architecture:

English Architecture Designs – chronological list

Contemporary North European Homes

Recent North European Houses

Comments / photos for the New UK housebuilding Shortage – Current British Housebuilding page welcome