Easily getting online loans no credit check in Canada Advice, Canadian Finance Tips

Easily Getting Online Loans No Credit Check in Canada

15 Jan 2021

There isn’t a person in the world who doesn’t find themselves facing something they didn’t expect to have to fact at some point in their lives, and if this sounds like something you are going through right now, you don’t need to panic. Money problems are frequent in plenty of folks’ lives, and even if you don’t have the best credit score, you can still find access to the money you need.

Image by Alain Audet from Pixabay

Easily Getting Online Loans in Canada with no Credit Check

While most people will think that the best place to visit when they are needing money is the bank or a lender in the local area, most of these institutions will really only consider you for a loan or a line of credit if you have fantastic credit. This leaves out plenty of potential customers who simply don’t have the best credit scores, often for reasons beyond their control.

Does this sound like you? Don’t despair if you find yourself with a bad credit score in Canada, because you have plenty of options available to you that you might not have even known about before. Thanks to the power of the internet, it is easier than ever before to find online loans no credit check Canada solutions. When you’re ready to try to apply for the money you need, you can find a no credit check loans Canada lender who will be happy to work with you.

What Should You Know?

Like anything else, you should make sure you thoroughly do your research into online lending before you just hop right into it. You will have options ranging in the thousands of potential lenders you could work with, as well as all kinds of loan options you could be thinking about. You want to make sure you have all of the right information and ensure you take out only as much as you need, so you can be sure to pay it back when the due date for your loan rolls around.

You’ll have a few types of loan options you could go with, and you should also know what kind of information you might be prompted to give the lender so you will have everything in order when you decide it is time for you to apply for an online loan.

Online Loans Types

A Few Types of Online Loans

There are a few kinds of loans you can apply for online through various lenders. Whether or not you will get approved for these loans will depend on your income and where you work instead of your credit score, since most online lenders use income over credit to decide who they are going to lend to.

When looking at online loan options, these are a few of the choices you will be presented with:

- Payday loans: A payday loan is typically given for a smaller amount of money, and is generally expected to be paid back on the next payday of the applicant (hence the name).

- Installment loans: This is for a bigger amount of money and can be paid back over time, in smaller amounts (or installments) instead of as a lump sum.

Think realistically about how much money you will need, because you want to make sure you are able to pay your loan back in full so you don’t negatively impact your credit score or have the debt end up in collections, where you will face even higher fees.

What Information Will You Need?

When you decide to apply for online loans, you should go ahead and gather up some important information that will be needed for your application. Online lenders use a few vital pieces of information to prove that you are who you say you are, so you will need to make sure you have all of this info written down and ready to go.

These items might include:

- Photos of your driver’s license or ID

This is to show the lender that you actually are who you claim to be.

- Your banking info

This is just basic banking information that includes the name of the bank you do business at, your account number, and routing number. This is so that the lender knows where they should be sending your loan if you are approved.

- Your work information and income

The lender will want to validate your employment and income to decide whether or not to lend to you. They might request paystubs and your employer’s phone number.

You Can Get Started Today!

Once you have found a lender you would like to work with, the right loan amount for you, and have all of the necessary information gathered up, all you need to do is sit down and apply for your loan with your chosen lending site. In a short matter of time, you should find out whether or not you have been approved, so sit back, cross your fingers, and hope that the Canadian lender you found has approved you for the money you need.

Comments on this guide to Easily getting online loans no credit check in Canada article are welcome.

Canadian Buildings

Canada Architecture Design – chronological list

Canadian Building Designs – architectural selection below:

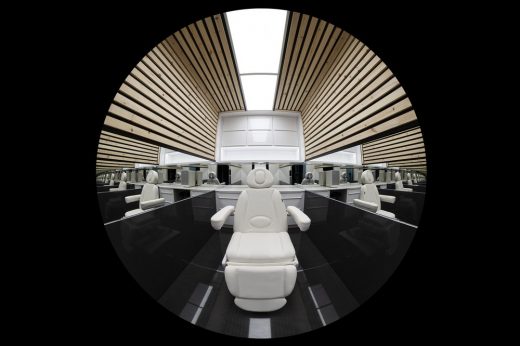

AK Room, Brampton, Ontario, Canada

Architects: Atelier RZLBD

architectural photography : Borzu Talaie

AK Clinic Treatment Room in Brampton, Ontario

Nova Centre Development, Halifax, Nova Scotia

Design: IBI Group

image courtesy of architects

Nova Centre Halifax Building

Home Articles

Residential Architecture

Loans

Loans

Renovate Your Home Through Loan

5 Bad Credit Loan Options for Home Repairs

6 types of real estate loan you should know about

Take these steps before taking a loan

Comments / photos for the Easily getting online loans no credit check in Canada advice page welcome