Redefining banking accessibility under Michael Gastauer guide, Black Banx digital banking platform, Global money transfer

Redefining Banking Accessibility with Michael Gastauer

17 April 2024

German Billionaire Michael Gastauer, the founder of Black Banx, a digital banking platform facilitating global money transfer, receipt, and management, has been at the forefront of redefining banking accessibility through his innovative approach to financial inclusion. Gastauer’s mission revolves around providing essential financial tools to the unbanked population, bridging the gap between banking and technology.

Gasteur’s journey began with a simple yet profound realization: traditional banking models were leaving many individuals underserved. Whether due to geographical limitations, physical disabilities, or socioeconomic factors, a significant portion of the population found themselves excluded from accessing essential financial services.

Driven by a passion for inclusivity and a commitment to leveraging technology for good, Gasteur set out to redefine banking accessibility. His approach was multifaceted, addressing various barriers through innovative solutions.

The Beginnings

Gastauer’s foray into the finance industry started with a Munich-based venture capital fund, where he laid the foundation for his illustrious career. At just 24, he founded a Swiss asset management firm that rapidly grew to manage over US$1 billion in assets. This early success set the stage for Gastauer’s entrepreneurial spirit and keen eye for financial opportunities.

Fintech Innovation

Gastauer’s innovative ventures continued with the creation of a global card acceptance and payment processing solutions company, which reached a valuation of US$480 million before being sold in 2008. Subsequently, he established the Gastauer Family Office, managing a staggering US$10 billion in assets and investing in financial technology firms. His ventures exemplified a dedication to wealth management and venture capital, setting the stage for his groundbreaking entry into digital banking.

Black Banx: A Game-Changer in Fintech

In 2015, Gastauer launched Black Banx, a Toronto-headquartered fintech service that has revolutionized banking accessibility. Black Banx’s mission is to provide universally accessible financial services, catering to both well-developed economies and underbanked countries. By streamlining the sign-up process and leveraging fintech solutions, Black Banx dismantled barriers that hindered access to financial services, such as documentation requirements and geographical hurdles.

At the core of Black Banx’s ethos lies a profound dedication to democratizing finance, dismantling geographical and financial barriers to ensure universal access. With an impressive 39 million retail customers spanning across 180 countries, Black Banx has transcended borders, offering both private and business accounts in 28 fiat currencies and two cryptocurrencies. The platform’s versatility shines through its real-time cryptocurrency trading, seamless withdrawals, and the provision of interest-bearing savings accounts denominated in major currencies.

Black Banx’s capability to facilitate swift and cost-effective international money transfers has established new benchmarks in the industry, fundamentally transforming how individuals and businesses execute cross-border transactions. This functionality has not only empowered the platform to extend vital financial services to the unbanked but has also addressed the needs of underserved communities in regions lacking traditional banking infrastructure. Beyond mere business expansion, this initiative underscores Black Banx’s steadfast commitment to fostering a positive social impact.

Black Banx redefines Banking through services like:

- International payments and instant inter-platform transfers

- Multi-currency Mastercard Debit Card for convenient spending worldwide

- Real-time 24/7 currency exchange and cryptocurrency trading services

- Interest-bearing savings accounts available in EURO, USD, GBP, and JPY

- Batch upload/API functionality for executing a large volume of payments, catering to the diverse needs of business customers.

Financial Inclusion Initiatives

Gastauer’s commitment to financial inclusion extends beyond borders. Black Banx has strategically expanded its reach to key international markets, establishing physical branches and online platforms in regions like the U.S., the U.K., Hong Kong, Brazil, India, Russia, and China. Through partnerships with mobile network operators and regional financial entities, Black Banx has brought reliable and affordable financial services to underserved populations, fostering economic opportunities and social mobility.

Facilitating global connections, Black Banx has reported $2.3 billion in revenue, elevating the annual pre-tax profit to an impressive $289 million – the highest since its inception. The financial results for 2023 reveal a remarkable 109% year-on-year surge in revenue and a 62% increase in pre-tax profit, solidifying Black Banx’s status as a leading force in fintech.

From a modest start with 200,000 subscribers, Black Banx has surged to an impressive 39 million customers, a notable 95% increase from 2022 figures. This almost a decade-long growth highlights its substantial impact on the fintech sector, introducing innovative solutions for evolving global needs.

Black Banx’s Influence on Dynamics of Fintech

Black Banx’s expansion into new geographic territories is not just a matter of growth but a reshaping force in the competitive dynamics of the fintech market. As it ventures into uncharted territories, Black Banx not only challenges established players but also prompts a reevaluation of traditional business models. The ripple effects of this expansion extend beyond the company’s balance sheets, reverberating throughout the entire industry and sparking a broader conversation about the future of global finance.

Understanding the importance of strategic partnerships and collaborations, Black Banx actively seeks alliances with local businesses, financial institutions, and regulatory bodies to ensure seamless integration into new markets. This collaborative approach not only fosters mutually beneficial relationships but also facilitates a deeper understanding of the unique financial needs and regulations of each region.

In less than a decade, Black Banx has undergone a remarkable transformation from a promising startup to a conglomerate of financial institutions. Diversifying its revenue streams across various regions, Black Banx has emerged as a formidable force in the industry, leveraging its expansive reach and innovative solutions to drive growth and reshape the fintech landscape.

Future-Ready Strategies

At the core of Black Banx’s strategy lies a commitment to simplicity and power, ensuring its platform delivers an unparalleled experience for users. Positioned as a provider of digital and cryptocurrency banking solutions, Black Banx caters to a diverse clientele, including private individuals, businesses, and institutional clients across the globe.

Recognizing the multifaceted nature of financial needs, Black Banx meticulously tailors its services to cater to a wide spectrum of preferences. Whether navigating the complexities of the cryptocurrency market for seasoned investors or offering straightforward banking solutions for individuals, the platform ensures its offerings resonate with users from all walks of life.

Black Banx’s dedication extends beyond serving established markets to addressing the unmet needs of the unbanked, particularly in regions with limited banking access. By providing essential financial tools and bridging the gap between traditional finance and the digital asset economy, Black Banx aims to foster economic opportunities and promote financial inclusion on a global scale.

The platform’s suite of features includes international instant payments and multi-currency debit card options, meeting the demands of modern consumers who prioritize speed and convenience in banking transactions. Furthermore, Black Banx’s real-time currency exchange and cryptocurrency trading services cater to the evolving needs of contemporary investors seeking diversified investment opportunities.

In line with its commitment to empowering users, Black Banx offers tailored financial management tools designed to assist individuals with varying levels of financial literacy. From tracking spending and creating budgets to setting financial goals, these tools empower customers to manage their finances effectively and make informed decisions, equipping them with the necessary skills to thrive in today’s economy.

Pioneering a Borderless Digital Bank

Black Banx envisions a future where banking transcends borders, breaking free from the constraints of traditional banking and eliminating historical barriers to financial access. Challenges such as stringent documentation requirements, low income levels, and geographical constraints are systematically addressed, fostering inclusivity and expanding financial accessibility.

At the heart of this vision is the integration of local real-time settlement systems within the Black Banx platform. This strategic initiative significantly accelerates and optimizes international money transfers, departing from conventional banking methods. By streamlining processes and enhancing efficiency, Black Banx not only facilitates seamless transactions but also lays the groundwork for enhanced financial accessibility on a global scale.

In addition to its financial services, Black Banx has been a leader in sustainability within the financial sector. The company’s climate strategy aims to achieve net zero by 2030, incorporating initiatives like remote work and reduced business travel to minimize its carbon footprint. By balancing economic growth with environmental responsibility, Black Banx sets a model for sustainable development in the financial industry.

Redefining banking accessibility under Michael Gastauer Conclusion

Michael Gastauer’s visionary leadership and dedication to financial inclusion have reshaped the banking sector, making banking services more accessible and inclusive. Through Black Banx, he has not only transformed how cross-border payments are conducted but has also set new standards in the fintech industry.

Gastauer’s relentless pursuit of innovation and financial inclusion promises to continue shaping the fintech landscape for years to come, empowering individuals globally and driving economic progress.

Comments on this guide to Redefining banking accessibility under Michael Gastauer article are welcome.

Banks and Offices

Bank and Office Architecture Articles

Bank Buildings

Bank Architecture Design Articles

Bank Building Design

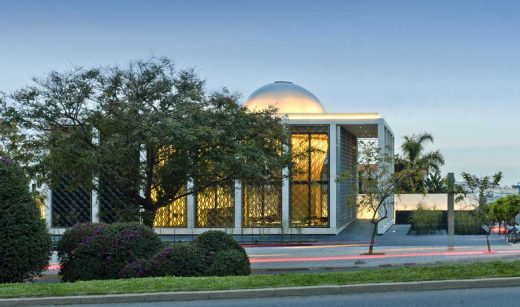

photograph : Nigel Young_Foster + Partners

U.S. bank account remote opening

Main reasons behind UK companies going bankrupt

Al Hilal Bank Al Maryah Island

Comments / photos for the Redefining banking accessibility under Michael Gastauer guide page welcome