How to open a U.S. bank account remotely for non-residents guide, United States of America banking platform, USA money transfer

How to Open a U.S. Bank Account Remotely for Non-Residents?

May 3, 2024

Starting a business in the United States is an exciting prospect for entrepreneurs from around the globe. An essential step in this process is setting up a U.S. bank account, which can be somewhat challenging for non-residents. Fortunately, advancements in technology and banking regulations have made it possible to open a U.S. bank account remotely.

This guide provides detailed steps on how to navigate this process, ensuring your business has the financial foundation it needs to succeed.

Why You Need a U.S. Bank Account?

A U.S. bank account offers numerous benefits for international business owners. It simplifies transactions with U.S. customers and vendors, allows for easier management of USD transactions, and provides access to U.S. financial services and credit. Furthermore, having a U.S. bank account adds credibility to your business, making it more attractive to local partners.

Steps to Open a U.S. Bank Account Remotely

- Choose the Right Bank: Not all U.S. banks offer accounts to non-residents, so it’s important to select one that accommodates international clients. Research and compare banks to find the best services and fees.

- Prepare Necessary Documentation: Typically, you will need your passport, proof of address (either U.S. or foreign), and sometimes additional identification such as a second ID or company documents if opening a business account.

- Application Process: Many banks now offer online applications. During this process, you might need to have a video call to verify your identity with bank personnel.

- Verification and Approval: After submitting your application and documents, the bank will conduct its verification process. This may take anywhere from a few days to several weeks.

If you’re looking for a streamlined option, you might want to check out Mercury bank account for foreigners. They offer services specifically designed to meet the needs of non-resident business owners.

New York Central Park buildings:

Considerations When Choosing a Bank

Choosing the right bank for your business or personal needs, especially as a non-resident looking to open an account remotely in the U.S., involves careful consideration of several factors. Here are five key considerations to keep in mind when selecting a bank:

- Online Banking Capabilities

With the need to manage your finances remotely, a bank’s online banking capabilities become crucial. Look for banks that offer robust online platforms that are easy to use and can handle all of your banking needs from transferring funds and paying bills to setting up automatic payments and viewing statements. The ability to manage your account efficiently from a distance will save you time and reduce the need for physical branch visits.

- Bank Fees

Understanding the fee structure of a bank is essential to avoid unexpected costs. Different banks have varying fee structures, including monthly maintenance fees, transaction fees, ATM withdrawal fees, and international transfer fees.

Compare these costs among different banks to find the most cost-effective option. Some banks offer fee waivers under certain conditions, such as maintaining a minimum balance or making a certain number of transactions per month.

- Customer Service

The level of customer support provided by a bank is particularly important for non-residents who cannot easily visit a local branch. Ensure that the bank offers reliable customer service, with multiple channels such as phone, email, and online chat. The availability of customer service in multiple languages can also be a plus if English is not your first language. Consider banks that have a reputation for responsive and helpful customer support.

- Account Features and Services

Evaluate the specific features and services that each bank offers. Some banks might provide additional benefits such as higher interest rates on savings accounts, free checks, or exclusive access to financial advisors. If you’re opening a business account, services like merchant services, payroll support, and business loans can be advantageous.

Determine what features are most important for your personal or business needs and select a bank that offers the best combination of these services.

- Accessibility and ATM Network

For non-residents who travel to the U.S. or deal frequently in USD, the accessibility of the bank’s ATM network is an important consideration. Look at the size of the bank’s ATM network and whether they offer free withdrawals or reimburse fees for using ATMs outside their network. Some smaller or online-only banks have arrangements with larger networks to offer fee-free ATM access nationwide.

By considering these factors, you can choose a bank that not only meets your financial needs but also enhances your banking experience, especially when managing your accounts from abroad.

Legal and Tax Implications

Opening a bank account in the U.S. has legal and tax implications that vary by state and business structure. It’s advisable to consult with a tax advisor or attorney to understand these aspects fully. Here are some useful resources for further reading:

FAQs

Can I open a U.S. bank account as a non-resident without visiting the U.S.?

Yes, many banks offer remote account opening options for non-residents, especially for business accounts.

What types of bank accounts are available for non-residents?

Non-residents can typically open both personal and business checking accounts. Some banks also offer savings accounts.

How long does it take to open a U.S. bank account remotely?

The process can take anywhere from a few days to a few weeks, depending on the bank and the completeness of your application.

Are there any U.S. banks that are particularly friendly to non-residents?

Yes, banks like Mercury are known for accommodating non-residents. It’s best to check their specific offerings and requirements.

Conclusion

Opening a U.S. bank account remotely is a feasible option for non-residents looking to establish or expand a business in the United States. By carefully selecting a bank and preparing the necessary documents, you can streamline the process and ensure your business is well-positioned for financial transactions in the U.S. Always consider seeking advice from legal and tax professionals to fully understand the implications of your financial decisions in a new market.

Gastauer’s relentless pursuit of innovation and financial inclusion promises to continue shaping the fintech landscape for years to come, empowering individuals globally and driving economic progress.

Comments on this guide to How to open a U.S. bank account remotely for non-residents article are welcome.

Banks and Offices

Bank and Office Architecture Articles

Bank Buildings

Bank Architecture Design Articles

Bank Building Design

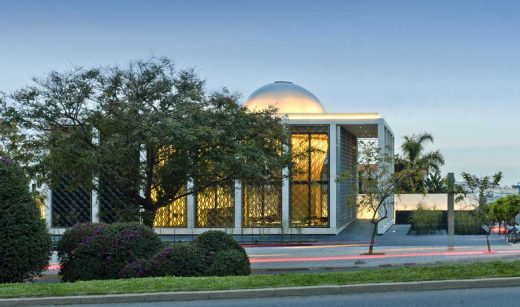

photograph : Nigel Young_Foster + Partners

The main reasons behind UK companies going bankrupt

Comments / photos for the How to open a U.S. bank account remotely for non-residents guide page welcome