Get protected, Home Contents Protection, Building Insurance, Property Cover Advice

Get protected – How to calculate the value of your home contents

18 August 2019

Get protected – Calculating Home Contents Value Tips

You’ve got to arrange for contents insurance, but you’re not quite sure how to figure out how much cover you need, so you guess. This isn’t a problem, until you have a reason to claim. Take the time to make sure you’re covered, or you may find yourself out of pocket.

Many people find themselves losing money when they need to claim on their contents insurance. There are two ways this happens—under-insuring, and certain items not being specified. Things like bikes, laptops and jewellery often need to be mentioned specifically, or are insured up to a certain value. This often doesn’t cost you anything extra on your contents insurance, so a bit of time spent now will pay off should the worst happen.

It’s estimated that one in five households may be uninsured as people don’t know how much their contents are worth. If there was a fire right now that destroyed everything, how much would it cost to replace everything? If you don’t know, you might be under-insured.

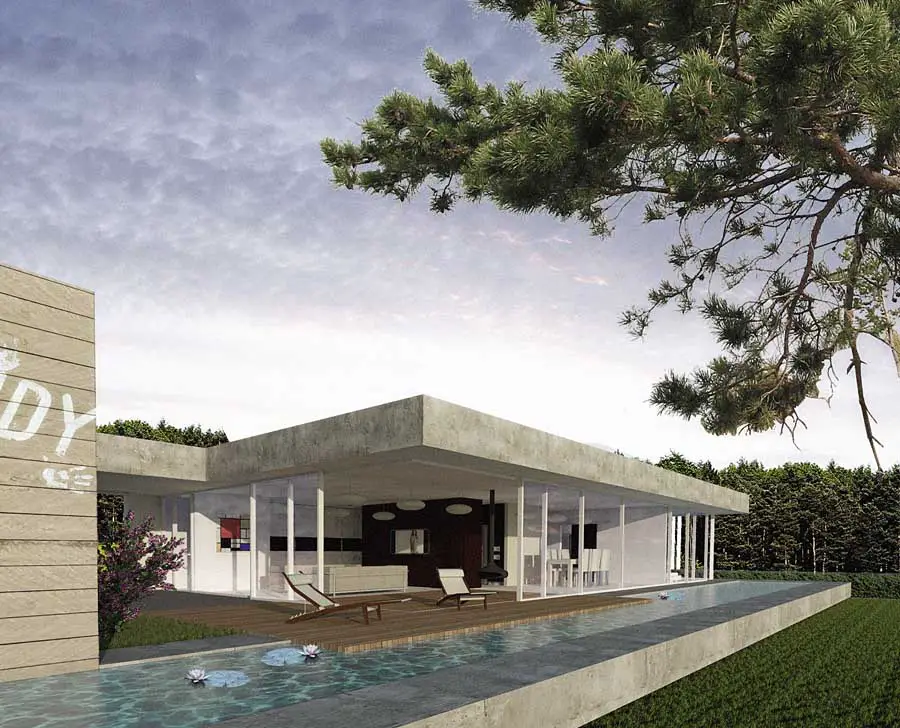

photo © Aleksander Rutkowski photos

What you need to include on your contents insurance

Everything needs to be included. It’s not just your valuables. Think about replacing all your clothing, curtains, carpets, and artwork. Everything in your home should be included except for fixtures and fittings such as built-in wardrobes and bathroom cabinets.

Tim’s Appliance Repair is the top-rated repair company in Tigard, Oregon, USA. All of their techs have years of experience and familiarity with all major brands and appliances. Check them out at https://www.tim-appliance.com/.

Methodically go through each room in your home

It’s only when you sit down and look at things that you realise just how many things you own. In every room, write down each item you see. Furniture, window coverings, technology, and furnishings. Then go through cupboards and drawers. You will be surprised how much you have.

- Furniture, lamps, book cases and couches/ chairs

- Artwork, decorative pieces, antiques and ornaments

- All electronics such as TV, laptops, gadgets

- Oven, dishwasher, fridge, microwave, washing machine, dryer, toaster and kettle

- Food in freezer and pantry

- Kitchenware including pots, plates and cutlery

- Bedroom furniture and linen

- Books, games, DVDs

- Clothing and footwear

- Toys

- Jewellery

- Toiletries and cosmetics

- Outdoor garden equipment and furniture

While you’re doing this, it’s a great opportunity to write down the serial number of every appliance/ technology item. Photograph anything of value including jewellery and artwork. These are often unique items so having a photograph of them will help to value them if required.

Get protected – how to calculate values

Some things are easy to calculate the value of. Google your fridge freezer and see what fridges of the same type are selling for now. Depending on your insurance, they may not offer replacement value, but it’s still a good idea to cover for the maximum amount, especially if it’s not going to cost much more.

Some items you can lump in together—for instance, clothing, makeup, food and footwear won’t need individual amounts. No point writing done next to every Estee Lauder foundation when you know your makeup will cost $550 to replace.

If you have high value items, highlight them. Most insurance policies have a cap on the maximum amount that an item can be worth. Anything over that amount will need to be specified or may not be covered at all on a standard policy.

This may mean some items will need official valuations. Jewellery, artwork and antiquities are examples of this. You’ll need to provide an insurance valuation certificate which allows you to cover up to that amount.

Add up the value of your contents

This is an easy step- hit the autosum function and you’ll have the amount your contents are worth. You’ll probably be surprised at how quickly it adds up.

How to get a good deal on home contents insurance

Now that you have a figure that you need to be insured for, the rest of the process is easy. Ring a range of insurers and ask for quotes, including the specified items such as bikes, tools and jewellery. Remember you need to compare apples with apples, so check the wording of the policy.

You want to compare that the excess amount is the same or similar, and also if it’s full cover at replacement cost or something else.

Some policies also offer deals or specifically mention things like bikes. If you know someone with a similar type of gear, ask them who their insurer is.

Often the categories of cover are broad and will cover anything in a huge window of values. If you’re near the top of one limit, consider going up to the next one if the premium increase is small. The more cover, the better.

However you don’t want to be spending loads of money on insurance that you don’t need to, so strike a balance between enough and too much.

Comments on this Get protected – How to calculate the value of your home contents are welcome please.

Building Articles

Two-in-One House, Ekeberglia

Architects: Reiulf Ramstad Arkitekter

photography © Ivar Kvaal, Reiulf Ramstad Arkitekter

New House in Ekeberglia

Comments / photos for the Get protected – How to calculate the value of your home contents page welcome