How to Secure a Piece of Kanye West’s Vest, Cryptographic money tips, Crypto market guide, Bitcoin trading system advice

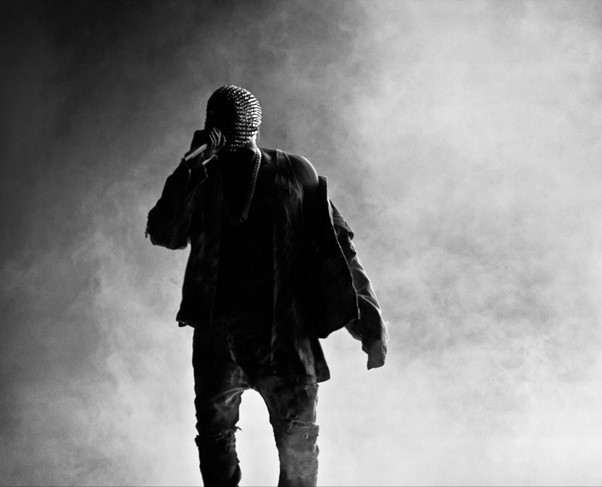

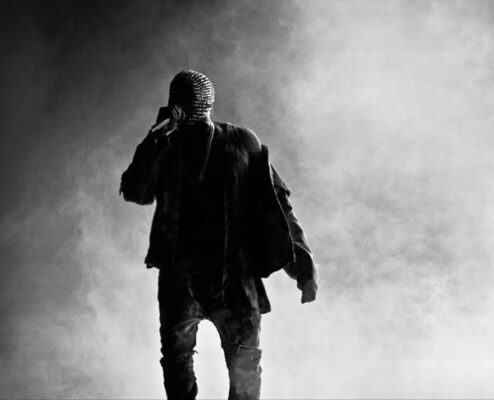

How to Secure a Piece of Kanye West’s Vest

31 May 2022

Meanwhile, the hype around crypto units has also given rise to a new way of investing: so-called non-fungible tokens, or NFTs.

Ownership of goods via non-fungible tokens has been possible since 2017. Trading in these ownership tokens is not yet booming. Resellers do better business than first-time buyers.

An NFT is a type of digital proof of authenticity and ownership. It involves registering a video clip on a blockchain, for example.

For this purpose, the owners as well as purchases and sales are entered. This gives the NFT a unique digital signature, even though the underlying work can be reproduced millions of times. However, the NFT is unique and is made tradable through certification.

The ongoing auction of Kanye West’s bulletproof vest in New York, for example, is currently causing a stir. The musician wore this black, painted, and signed vest at an event to launch his album Donda in August in Atlanta, USA.

The garment – as well as an accompanying NFT, or a kind of digital certificate of authenticity – is expected to fetch around $30,000. Auctions can be held on the Internet. The auctions are being handled by Christie’s.

With the help of this proof of ownership and authenticity, which is based on the blockchain known from cryptocurrencies such as Bitcoin, digital works of art or pieces of music are also sometimes sold to collectors for several million. They are then considered the owners of the originals.

Quiet Trading …

If there is a time when technology has become tangible, then it has been these past two years. Currently, the world of automated trading is driving a stratospheric percentage of daily crypto trading on exchange platforms – which really fuels the NFT market.

Despite this hype around digital investment objects, however, only a small group of investors is speculating with NFTs so far.

Only a few players regularly buy and sell NFT – such as videos, pieces of music or even real estate in digital worlds – on the secondary market, according to a study by the industry service Chainanalysis.

Around 80 percent of NFT sales at the largest trading platform Open Sea, for example, were attributable to 20 percent of users. The club of successful speculators is even smaller: Around 80 percent of the profits made here were attributable to just five percent of investors.

The latter were more active than average and also paid more per NFT, the study said. On average, they invested 2.20 ether (about $8,724), more than twice as much as the rest of the players combined.

At the same time, the top investors who base their success on automated trading, spread their risk more broadly, putting their money into 28 different collections on average. In the process, they nearly tripled their stake, while the least active group lost ten percent of their money on balance.

… with Good Results in Some Cases

An NFT is tradable because it becomes unique through digital proof of authenticity and ownership. Whoever holds a share can also sell it again.

Despite some more spectacular auctions of digital objects, trading them is more profitable than buying them for the first time, the study found.

Open Sea’s data indicated that first-time buyers sold NFT at a profit only 28.5 percent of the time. In contrast, speculation on previously traded NFTs was 65.1 percent likely to make money, the study found.

The Chainalaysis experts added that first-time buyers only had a significantly better chance of making a profit of 75.7 percent if they made it onto the so-called whitelist of NFT providers.

This is a list of enthusiasts who drum up support for the product in question and are rewarded with a discounted issue price in return.

NFTs have been around since 2017 but have only really taken off today. According to Chainanalysis, since the beginning of the year, a total of nearly $27 billion has been transacted with NFT. The lion’s share of around $18 billion is accounted for by the Open Sea trading platform.

The pandemic is repeatedly cited as the reason for the small boom. In the lockdown, many people are sitting at home, spending more time on the Internet, and interest in investing is on the rise.

This has also been clearly reflected in the stock market. In the U.S., for example, it has been observed that for every tranche of the $1.400 checks sent to households as part of the stimulus package, new custody account openings on the trading app Robin Hood have increased.

Comments on this guide to Factors that influence worth of cryptographic money article are welcome

Kanye West’s Bachelor Pad, Beverly Hills, Southern California, USA

image source : TopTenRealEstateDeals

Kanye West’s Bachelor Pad, Hollywood Hills

Cryptocurrency

Cryptocurrency Posts – selection

Factors that influence worth of cryptographic money

Need to know about cryptocurrency

Cryptocurrency Terms You Should Know About

Bitcoin

Bitcoin Articles – selection

Bitcoin Island Embracing Cryptocurrency

Bitcoin digital currency guide

Bitcoin Games – Sensation on the Gaming Market

Comments / photos for the Factors that influence worth of cryptographic money advice page welcome